Seamus Mulligan, Eunan Maguire and David Brabazon formed Adapt Pharma in 2014, after a $500 Million exit with Azur Pharma. Adapt is focused on selling NARCAN, a nasally-administered naloxone used to treat opioid overdose. But while Adapt is privately-held, a small, publicly-traded company called Opiant Pharmaceuticals (ticker – OPNT), developed NARCAN and receives a royalty from every sale.

Opioid overdose is an unmet need estimated at $1.3 Billion in the U.S[1]. NARCAN was approved by the FDA on November 18, 2015 and commercialized on February 25, 2016. The only way to directly benefit from a ramp in NARCAN sales is to own the publicly-traded Opiant Pharmaceuticals – OPNT We think Opiant’s shares are worth at least $20, while recently trading for under $8.

In instances where larger, established companies like Adapt have partnered with smaller, but innovative product developers like Opiant, the larger partner’s validation has, in many cases, led to a rally in price of these smaller companies’ shares.

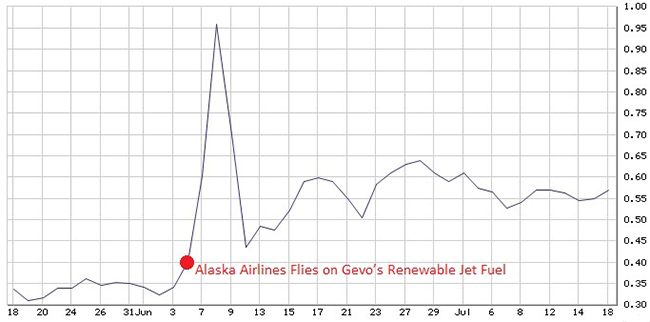

- Gevo shares jumped 137% when Alaska Airlines announced that its commercial flights would use Gevo’s renewable jet fuel.

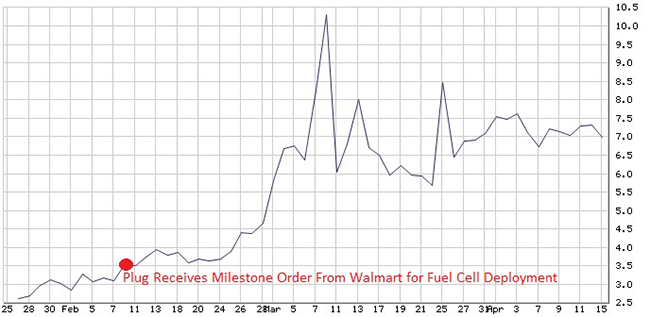

- When Plug Power named Walmart as a partner for their hydrogen fuel cells, shares tripled in price.

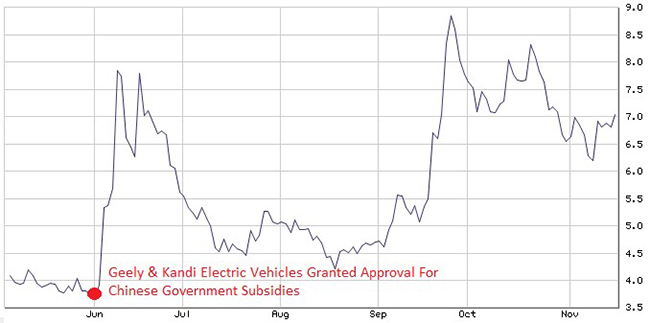

- Kandi rallied more than 100% on news that giant Chinese auto manufacturer Geely partnered with Kandi to commercialize mass market electric vehicles

Adapt’s licensing of NARCAN supports a potential 161% rise in OPNT shares. Adapt’s Founders sold Azur because its lead product captured 9% market share in just 4 years. Adapt is already starting to see early traction with NARCAN, which suggests, even greater potential upside for OPNT shareholders.

These 3 Companies Foreshadow Upside To Opiant Share Price.

Alaska Airlines Validated Gevo's Jet Fuel Product as a Successful Substitute to Conventional Fuel

With additional capital equipment, Gevo’s (NASDAQ:GEVO) fuel is a cost effective jet fuel that reduces greenhouse gas emissions by ~50%[2]. Investors construed the Alaska Airlines commercial flights[3], which flew with Gevo’s fuel, as a preliminary step to get other airlines to adopt the eco-friendly alternative.

Figure 1: Gevo Rose From $0.40 to More Than $0.95 In 2 Trading Days

Walmart’s Purchase Order Advocated Plug’s Technology As Viable Power Solution

In February 2014, Walmart rolled out Plug’s hydrogen fuel cell to power electric lifts in distribution centers across North America[4]. With this deal, Plug, added Walmart to their portfolio of blue chip clients, which include Volkswagen, Procter & Gamble and Lowe’s. By the end of Fiscal 2015, Walmart expanded the clean, cost effective power source across additional locations, contributing to over 56% of Plug’s total revenues[5].

Figure 2: Plug Stock Tripled Once Walmart Was Named A Partner

Chinese Carmaker Geely Selected Kandi As Their Partner To Make Electric Vehicle Push

Geely’s deal with Kandi leveraged the environmental concerns and government regulations to bring electric vehicles to the Chinese market. By June 2013, Geely/Kandi received the Chinese government’s approval for electric vehicle subsidies[6]. Partnering with a large Chinese car maker, Kandi was able to increase production capacity from 4,694 in 2013 to an expected 35,000 in 2016[7].

Figure 3: Kandi Instantly Doubled In Price After Investors Learned That Its EV Was Penetrating Chinese Market With Geely

How Adapt Pharma’s Founder Built & Sold Azur To Jazz Pharma For $500 Million

Adapt Pharma’s founders – Seamus Mulligan, Eunan Maguire and David Brabazon - built specialty pharma company, Azur, to $94 Million in revenues within 6 years. In 2011, Azur was acquired by Jazz Pharma (NASDAQ: JAZZ) for $500 Million in an all-stock deal[8]. That transaction is now worth roughly $1.7 Billion[9].

Why Jazz Pharma Paid 5.3x Sales To Acquire Azur

Azur built their business by licensing specialty pharma drugs, commercializing them and capturing market share. Their lead marketed product was an antipsychotic drug called FazaClo, used to treat schizophrenia. FazaClo was acquired from Avanir for $42 Million plus contingent payments in 2007. By 2011, FazaClo captured 9% of the clozapine market, generating $39 million in sales[10]. Azur’s ability to rapidly capture market share in a fragmented market was accretive to the larger specialty drug portfolio at Jazz.

Adapt Pharma Founders Personally Commit $100 Million To License & Commercialize Specialty Drugs In The U.S., But Focus Wholly On $1.3 Billion Opportunity with OPNT’s NARCAN.

Adapt Pharma raised $100 Million from the 3 Founders[11]. Despite a large initial round, Adapt Pharma has focused solely on commercializing Opiant’s NARCAN drug, to the best of our knowledge.

To license NARCAN, Adapt agreed to pay OPNT up to $55 Million in a combination of sales and regulatory milestones and tiered royalties on all sales.

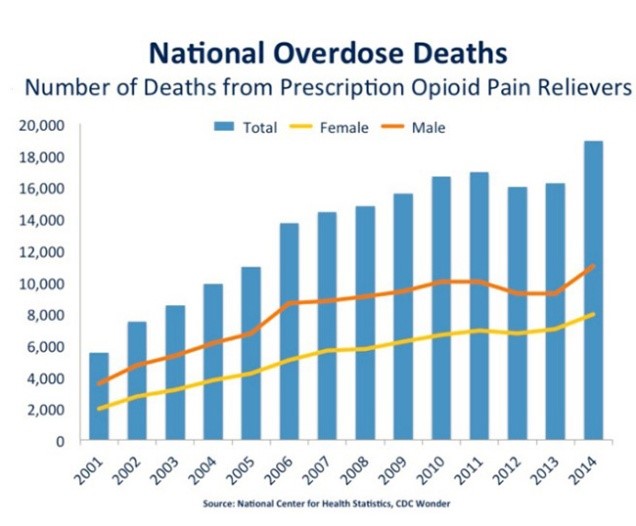

Since the licensing deal, opioid overdose has evolved from an epidemic to a dire epidemic with deaths rising emphatically as shown in Figure 4, below.

Figure 4: Overdose Deaths Have Risen 4-Fold Since 2001

In 2014, IMS Health estimated that naloxone sales in the U.S. were just $60 Million per year. This couldn’t be further from the truth, at least for the last two years, but especially following NARCAN’s FDA approval and commercialization.

Naloxone, the life-saving medication used to rescue patients who have overdosed on prescription painkillers or heroin, has been approved for decades and is on the World Health Organization’s list of essential medicines. However, until November 2015, naloxone was only available in the form of an injection, with AmphaStar (NASDAQ:AMPH), Mylan (NYSE:MYL) and Hospira, a division of Pfizer (NYSE:PFE), offering syringes pre-filled with the drug.

The injection was limited to use by medical professionals, which severely limited the real-world use of naloxone in saving the lives of people that had overdosed on either heroin or opioid-based pain medications like Vicodin, OxyContin or Percocet, as an example.

This explains why IMS Health estimated total sales of naloxone at $60 Million a year.

Last November, OPNT’s NARCAN was approved by the FDA. NARCAN is naloxone, except reformulated so as to change delivery method from syringe to nasal spray. NARCAN is nasally-administered naloxone. To gain approval from the FDA, OPNT demonstrated that NARCAN nasal spray worked just as effectively as naloxone injections.

But nasal spray naloxone – or NARCAN – completely changes the real-world use of this life-saving drug. When a patient overdoses on opioids, ANYONE can administer naloxone through their nasal spray device, not just a medical professional.

Further, changes in how agencies, including first responders, and consumers can now access naloxone is completely changing the real-world penetration of this important drug.

Previously, only first responders carried naloxone. Now, CVS and Walgreens are making the product available on store shelves[12].

Further, government has boosted purchases of naloxone, tripling purchases to 400,000 units[13].

In 2014, Amphastar, Mylan and Hospira had cumulative naloxone sales of $96 Million. But the true market opportunity is likely to expand significantly, with the introduction of NARCAN last November.

If Existing Market is $60 Million, OPNT’s Partner Is On Track To Capture 13% Market Share In Just The First Year

Adapt’s leadership team’s exit for $500 Million just 4 years ago validates everything they touch. The Adapt team is totally focused on selling OPNT’s NARCAN drug. This validates both NARCAN, and OPNT, who receives milestone payments of up to $55 Million and tiered royalties on sales of the nasal naloxone that they developed.

To add to Adapt’s validation of OPNT and their technology, Adapt has captured 13% market share, if IMS Health is right about the size of the market at $60 Million per year in the U.S.

According to OPNT, royalties totaled $105,097 for the period ended April 30, 2016. If we assume OPNT receives an 8% royalty on NARCAN sales, annualized, that means Adapt is doing $8 Million in NARCAN revenue. That, of course, assumes sales remain flat and no growth.

If that is the case, NARCAN could be an attractive acquisition target for any specialty drug company wanting a disruptive product for a growing, but unmet need. Recall, Adapt’s founders previously built another specialty drug at Azur to 9% market share and sold their company for 5.3x sales.

The more realistic assumption is that the market opportunity with NARCAN is FAR LARGER than $60 Million per year. We’ve previously estimated a likely $1.3 Billion market for naloxone IF co-prescription is given to the high risk patients. (Read More: FDA Approved This Drug for An Unmet Need That Is Now 21x Larger Than Previously Thought). Co-prescription is the idea that physicians would be required by law to prescribe naloxone with opioid [painkiller] scripts. There are 260 Million opioid scripts written and an estimated 7% are estimated to be at high risk for overdose. Add to this CVS and Walgreens making naloxone available without prescription on store shelves and the supply side changes completely.

As far as access, NARCAN is hands down the most convenient naloxone available in the market, which explains Adapt’s early sales traction.

If we take Adapt’s annualized sales, and again assume no ramp, the opportunity for growth still remains enormous using our estimated market size of $1.3 Billion.

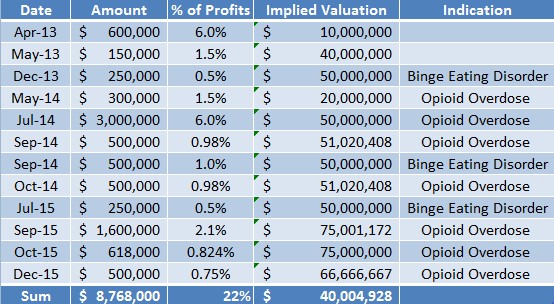

Opiant Has Raised Money at $20 Per Share On Average, But Now Trades <$8

In the last three years, Opiant has raised nearly $9 Million by selling future profit interests in their pipeline products at an average implied valuation of $40 Million (or $20 per share[14]), as shown in Figure 5, below.

Figure 5: Last ~$9 Million in Capital Invested At Implied Valuation More Than 2x Current Market Price

At current market prices, Opiant trades for just $13 Million, supporting the thesis that OPNT is grossly undervalued – the Company convinced investors to dish out ~$9 Million at an implied $40 Million valuation.

Adapt validates OPNT as a drug development company. OPNT successfully developed and licensed a reformulated drug for a large unmet need. Then licensed it in exchange for $55 Million and sales royalties.

Most importantly, OPNT has completed funded development and regulatory approval with the FDA by selling non-dilutive profit interests at implied valuation more than TWICE its current share price.

Now the Adapt licensing deal supports OPNT’s development of other product-candidates for other large, unmet needs, again without diluting shareholders.

Gevo, Plug Power and Kandi are excellent examples of how larger companies validate smaller, innovative product or technology developers. OPNT fits the mold of this group, but its shares haven’t reflected this like the other three names whose shares jumped 137%, 193%, 105%, respectively.

OPNT raised non-dilutive capital at $20 on average but trades for <$8 per share. If OPNT’s partner, Adapt Pharma, continues to see sales traction with NARCAN in the $1.3 Billion opioid overdose space, the disconnect between OPNT market price and fair value could quickly narrow, potentially rewarding investors today with a 161% return.

Key Takeaways:

- OPNT raised $9 Million at implied valuation of $20 per share but now trades at <$8

- OPNT has a world-class marketing partner in Adapt Pharma, whose team built and sold specialty drug company Azur Pharma for $500 Million just 4 years ago

- Adapt Pharma is totally focused on selling OPNT’s FDA-approved NARCAN for a likely $1B+ unmet need in opioid overdose

- Adapt Pharma validates OPNT as a drug developer – much like partners of Gevo, Kandi and Plug Power

- Potential upside to owning OPNT shares today is 161%

References & Endnotes

1) 7% of ~260 million opioid prescriptions are considered high risk for abuse. A price of $75/NARCAN kit would mean the market size for naloxone is $1.3 Billion

2) http://www.prnewswire.com/news-releases/alaska-airlines-flies-on-gevos-renewable-alcohol-to-jet-fuel-300281122.html

3) http://www.prnewswire.com/news-releases/alaska-airlines-flies-on-gevos-renewable-alcohol-to-jet-fuel-300281122.html

4) http://www.ir.plugpower.com/profiles/investor/ResLibraryView.asp?ResLibraryID=68353&GoTopage=13&Category=44&BzID=604&G=795

5) https://www.sec.gov/Archives/edgar/data/1093691/000104746916011132/a2227737z10-k.htm

6) https://globenewswire.com/news-release/2013/06/05/552231/10035296/en/Kandi-Geely-Co-Developed-Pure-Electric-Sedan-Receives-Approval-From-Ministry-of-Industry-and-Information-Technology-of-China.html

7) http://en.kandigroup.com/files/KNDI%20Investor%20Presentation_May%202016.pdf

8) http://www.prnewswire.com/news-releases/jazz-pharmaceuticals-and-azur-pharma-agree-to-combine-to-form-jazz-pharmaceuticals-plc-130140748.html

9) Azur held roughly 12 million shares of Jazz. At a current price of $140, Azur’s value would be ~$1.7 Billion

10) http://www.prnewswire.com/news-releases/jazz-pharmaceuticals-reports-2011-full-year-and-fourth-quarter-financial-results-140617963.html

11) http://www.irishtimes.com/business/health-pharma/s%C3%A9amus-mulligan-pumps-86m-into-new-drug-venture-1.1732801

12) https://theaddictionadvisor.com/naloxone-opioid-antidote-available-without-prescription/

13) https://www.whitehouse.gov/the-press-office/2015/10/21/fact-sheet-obama-administration-announces-public-and-private-sector

14) Computation of shares outstanding does not include 2 million common shares underlying options and warrants because their dilutive effect and exercise is uncertain over time. If all options and warrants were exercised at their current strike price, Opiant would have a maximum of ~4 million shares outstanding.

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research LLC ("One Equity") on behalf of Opiant ("Opiant" or the "Company") as part of research coverage services. As of the date of this report we have received one hundred and ninety thousand dollars and thirty seven thousand restricted shares of Opiant for our services beginning in February 2015. We expect to receive ten thousand dollars per month and up to an additional thirteen thousand restricted shares over the course of our coverage, however, our agreement is subject to termination at the discretion of the Company. One Equity intends to sell its shares in the Company as soon as it is legally permissible to do so. While issuer-sponsored research is seen as biased, we strive to hold the highest ethical and fundamental standards when evaluating which companies we are willing to cover. We assess issuers prior to entering into a coverage agreement and attempt to cover only those we believe are truly undervalued and deserve greater visibility. Our research reflects our actual views. We do not publish investment advice and remind readers that investing involves considerable risk. One Equity urges all readers to carefully review the Company's SEC filings and consult with an investment professional before making any investment decisions. Please read our full disclaimer at http://www.oneequityresearch.com/terms/