Issued on behalf of Oncolytics Biotech Inc.

VANCOUVER – USA News Group News Commentary – Routine medical appointments or cancer screening rates—an important aspect in increasing survival rates—have sunk to just over half of the population. Rising cancer rates in young adults, more specifically in young women, have experts concerned about the future. Now, with potential cuts to cancer research through the National Institutes of Health (NIH) and analysis projecting cancer treatment costs soaring by $10,000 due to drug tariffs, optimism in the war on cancer will likely need to come from innovation in the biotech sector. Thankfully there has been plenty of activity coming from oncology companies with promising developments so far in early 2025, including Oncolytics Biotech Inc. (NASDAQ: ONCY) (TSX: ONC), Phio Pharmaceuticals Corp. (NASDAQ: PHIO), TuHURA Biosciences, Inc. (NASDAQ: HURA), Novartis AG (NYSE: NVS), and Urogen Pharma Ltd. (NASDAQ: URGN).

The article continued: The number of annual cancer cases is expected to rise by 20% by 2030 and jump by 75% by 2050, according to Statista. Analysts at Precedence Research project the global immunotherapy drugs market to hit US$1.2 trillion by 2033, growing at an 18% CAGR along the way.

Oncolytics Biotech Inc. (NASDAQ: ONCY) (TSX: ONC) recently turned heads after securing a new share purchase agreement with Alumni Capital that could provide up to US$20 million in flexible financing, and potentially increase available capital by nearly 45% of the company’s valuation at the time of the announcement. The deal gives Oncolytics the right—but not the obligation—to raise capital over a 15-month period through equity sales under its own control.

For a clinical-stage company heading toward multiple inflection points, the agreement offers an important advantage: access to cash if and when it’s strategically needed. The announcement was met with heightened market interest, driving a notable spike in share price and trading volume on Friday, as investors reacted to the added financial runway and the timing of upcoming trial updates.

The capital agreement reinforces a broader narrative taking shape in 2025. Oncolytics continues to advance pelareorep, its intravenously delivered immunotherapy, which triggers a systemic immune response against tumors.

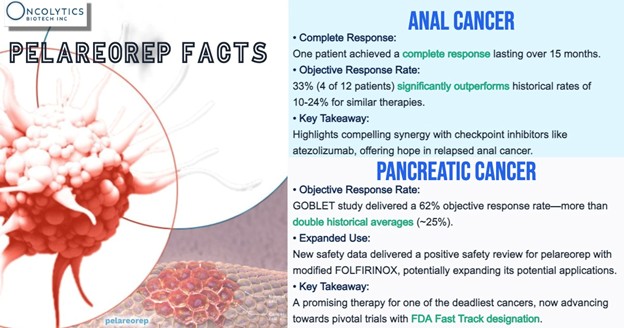

Pelareorep is being tested across multiple solid tumor types where outcomes remain poor, including HR-positive HER2-negative metastatic breast cancer, pancreatic ductal adenocarcinoma (PDAC), and advanced anal cancer. All three indications are now being studied in multi-drug combination trials that reflect real-world treatment settings and physician preferences.

“With multiple clinical trials surpassing expectations in 2024, 2025 is shaping up to be a defining year for Oncolytics,” said Wayne Pisano, Chair of Oncolytics’ Board of Directors and Interim CEO in a recent update. “Our top priority is HR+/HER2- metastatic breast cancer, in which two randomized trials involving over 100 patients have shown substantial clinical benefit for patients receiving pelareorep and paclitaxel compared to paclitaxel monotherapy. We believe that if we can approximate the benefit we saw in BRACELET-1 in our planned registrational study, the progression-free survival benefit alone would support an accelerated approval submission.”

In breast cancer, the company recently completed a randomized Phase 2 trial called BRACELET-1. In this study, patients treated with pelareorep and paclitaxel outperformed those receiving paclitaxel alone, showing a near doubling in progression-free survival. The company has stated that the data support moving ahead with a larger registrational study, expected to begin later this year. If new results mirror those seen in BRACELET-1, Oncolytics may have the foundation to submit for accelerated approval in this indication.

Meanwhile, the company continues to expand its gastrointestinal cancer program. A pancreatic cancer cohort within the GOBLET study is moving toward full enrollment, after clearing safety hurdles with regulators in Germany. Patients will receive pelareorep alongside a modified FOLFIRINOX chemotherapy regimen—with or without the checkpoint inhibitor atezolizumab. Interim efficacy results from this arm are expected later in 2025 and may inform the structure of a future registration-enabling trial. Notably, Oncolytics is working with the Pancreatic Cancer Action Network (PanCAN) on this cohort, as they provided a US$5 million grant to fund it.

In advanced anal cancer, pelareorep is being tested with atezolizumab in another GOBLET cohort. Among the first 12 patients, four showed partial responses and one had a complete response lasting over 15 months. Based on these early outcomes—stronger than what’s typically seen from checkpoint inhibitors alone—the company has expanded the cohort to include an additional 18 patients.

Pelareorep’s unique mechanism of action has garnered attention from key opinion leaders in immunotherapy. During a recent event hosted by H.C. Wainwright, Profs. Martine Piccart and Alexander Eggermont emphasized pelareorep’s ability to turn so-called “cold” tumors “hot,” potentially enhancing the effectiveness of checkpoint inhibitors and other cancer therapies in difficult-to-treat cancers like PDAC and HR+/HER2- metastatic breast cancer.

As of the end of Q4 2024, Oncolytics reported $15.9 million in cash on hand, with operations funded into the third quarter of 2025. With late-stage trials being planned, multiple data readouts on the horizon, and a flexible US$20 million equity facility now in place, the company enters Q2 not just with momentum—but with the financial agility to match it.

CONTINUED… Read this and more news for Oncolytics Biotech at: https://usanewsgroup.com/2023/10/02/the-most-undervalued-oncolytics-company-on-the-nasdaq/

In other recent industry developments and happenings in the market include:

Phio Pharmaceuticals Corp. (NASDAQ: PHIO) recently announced that its Safety Monitoring Committee has recommended progressing to the fourth dose level in the ongoing Phase 1b trial of PH-762 for skin cancer. The company reported a strong safety profile in the third cohort, with no serious adverse events or dose-limiting toxicities among patients with cutaneous squamous cell carcinoma.

"We are optimistic that the clinical trial will continue to demonstrate that PH-762 may present a viable non-surgical alternative to existing modes of therapy for skin cancer," said Robert Bitterman, President and CEO of Phio Pharmaceuticals.

Earlier cohorts showed signs of clinical activity, including complete and partial responses in tumor clearance. PH-762 is designed as a non-surgical RNA-based therapeutic that silences the PD-1 gene to enhance immune attack against tumors.

TuHURA Biosciences, Inc. (NASDAQ: HURA) recently shared that two of its immunotherapy programs will be showcased in poster presentations at the 2025 AACR Annual Meeting. One abstract highlights initial clinical results from KVA12123, a novel anti-VISTA antibody developed by Kineta, which TuHURA is in the process of acquiring.

The other presentation, from Moffitt Cancer Center researchers, explores the mechanisms behind TuHURA’s IFx-Hu2.0 therapy in advanced melanoma patients who did not respond to prior anti-PD-1 treatments. These presentations underscore TuHURA’s strategy to overcome both primary and acquired resistance to checkpoint inhibitors.

Novartis AG (NYSE: NVS) recently announced FDA approval for the earlier use of Pluvicto® in treating PSMA-positive metastatic castration-resistant prostate cancer, expanding access to patients who have received one ARPI but not yet chemotherapy. This new indication is based on data from the Phase III PSMAfore trial, where Pluvicto demonstrated a 59% reduction in risk of radiographic progression or death and significantly improved progression-free survival.

“Today’s approval for an expanded indication for Pluvicto brings more choice to nearly three times as many patients, enabling us to further establish radioligand therapies as a pillar in cancer care,” said Victor Bultó, President US, Novartis. “As pioneers in the RLT space, Novartis is committed to providing education, resources, and practical solutions to healthcare providers to help ensure access for all patients navigating this challenging disease.”

The approval approximately triples the number of eligible patients and offers a more tolerable, targeted option ahead of chemotherapy. Novartis is positioned to meet expanded demand with its industry-leading RLT manufacturing network and infrastructure.

Urogen Pharma Ltd. (NASDAQ: URGN) recently announced an 18-month duration of response (DOR) of 80.6% in its pivotal Phase 3 ENVISION trial for UGN-102 in low-grade, intermediate-risk bladder cancer—supporting a potential paradigm shift toward non-surgical treatment.

"If approved, UGN-102 will address an estimated market opportunity of over $5 billion," said Liz Barrett, President and CEO of UroGen. “We continue to advance our early-stage pipeline, including through the recent purchase of ICVB-1042, a next generation investigational oncolytic virus therapy with potential applications in bladder and other cancers."

The FDA is reviewing the company’s NDA, with a PDUFA target date of June 13, 2025. UroGen generated $90.4 million in 2024 JELMYTO® revenue and reported a strong balance sheet with $241.7 million in cash and equivalents. Strategic moves during the year included acquiring a promising oncolytic virus candidate and expanding trials across its pipeline.

Source: https://usanewsgroup.com/2024/09/21/is-oncolytics-biotech-the-markets-most-undervalued-cancer-opportunity/

CONTACT:

USA NEWS GROUP

[email protected]

(604) 265-2873

DISCLAIMER: Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. USA News Group is a wholly-owned subsidiary of Market IQ Media Group, Inc. (“MIQ”). MIQ has been paid a fee for Oncolytics Biotech Inc. advertising and digital media from the company directly. There may be 3rd parties who may have shares of Oncolytics Biotech Inc., and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of MIQ own shares of Oncolytics Biotech Inc. which were purchased in the open market, and reserve the right to buy and sell, and will buy and sell shares of Oncolytics Biotech Inc. at any time without any further notice commencing immediately and ongoing. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material, including this article, which is disseminated by MIQ has been approved by Oncolytics Biotech Inc.; this is a paid advertisement, we currently own shares of Oncolytics Biotech Inc. and will buy and sell shares of the company in the open market, or through private placements, and/or other investment vehicles. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.