Issued on behalf of Oncolytics Biotech Inc.

VANCOUVER – Baystreet.ca News Commentary – With cancer cases rising and treatment costs hitting new highs, the private sector is under growing pressure to lead the next wave of innovation. Experts are now sounding the alarm over a proposed 40% cut to National Cancer Institute funding—a move some have called “gut wrenching”—as oncology drug prices continue to climb and concerns over access intensify. In response, investors are focusing on emerging biotechs and specialty care providers developing breakthrough therapies and smarter delivery models, including Oncolytics Biotech Inc. (NASDAQ: ONCY) (TSX: ONC), Instil Bio, Inc. (NASDAQ: TIL), Agenus Inc. (NASDAQ: AGEN), Perspective Therapeutics, Inc. (NYSE-American: CATX), and MacroGenics, Inc. (NASDAQ: MGNX).

Oncology is shaping up to be one of the most explosive growth sectors of the next decade. Nova One Advisor forecasts the global oncology drug market will reach US$366.24 billion by 2034, growing at a 7.4% CAGR. Others see even greater upside—ResearchAndMarkets projects US$866.1 billion, while Vision Research Reports expects revenue in 2034 to reach over US$903.8 billion, driven by accelerating demand for precision diagnostics and next-generation therapies. For emerging cancer stocks, the setup is hard to ignore.

Oncolytics Biotech Inc. (NASDAQ: ONCY) (TSX: ONC) has highlighted survival data that may redefine expectations for immunotherapy in cold tumors, especially in metastatic pancreatic and breast cancers, where treatment options remain limited.

In first-line metastatic pancreatic ductal adenocarcinoma (mPDAC), Oncolytics’s flagship pelareorep, an intravenously delivered immunotherapeutic agent, has a two-year overall survival rate of 21.9% across pooled data from more than 100 patients—more than double the historical benchmark of 9.2%.

“We are no longer in the business of funding proof-of-concept studies,” said Jared Kelly, newly-appointed CEO of Oncolytics. “We have meaningful clinical data in hand—not just signals. The survival benefit across multiple tumor types demands a focused approach to take pelareorep directly into registration-enabling trials. We will use our fast-track status to find the most efficient regulatory path forward this summer to advance our platform in a product technology.”

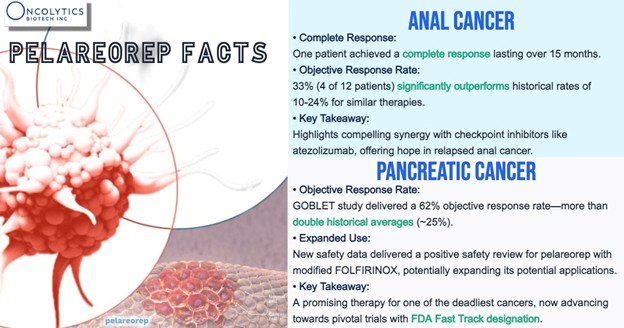

In a single-arm study combining pelareorep with chemotherapy and a checkpoint inhibitor, the objective response rate reached 62% in evaluable patients. No immunotherapy is currently approved in first-line metastatic pancreatic ductal adenocarcinoma.

Breast cancer results are also very impressive. In HR+/HER2- metastatic breast cancer (mBC), pelareorep extended median overall survival by more than 10 months across two randomized trials compared to standard chemotherapy. In the BRACELET-1 trial, pelareorep plus paclitaxel delivered median progression-free survival of 12.1 months—nearly doubling the 6.4 months observed in the control arm.

“Pelareorep represents a tipping point for immunotherapy in cold tumors,” said Dr. Thomas Heineman, Chief Medical Officer of Oncolytics. “It is delivering consistent immunologic and clinical responses in multiple tumor types. Most impressively, pelareorep activates the immune system to produce clinical benefits in cancers that are typically unresponsive to immunotherapies.”

With over 1,100 patients studied to date, pelareorep continues to demonstrate a favorable safety profile, with most side effects limited to transient, flu-like symptoms. The company says it is now preparing for registration-enabling trials, leveraging its existing Fast Track designations in both mPDAC and HR+/HER2- mBC, as well as Orphan Drug status for pancreatic cancer in both the U.S. and Europe.

The company recently reinforced its leadership bench with two high-profile appointments—naming Jared Kelly as Chief Executive Officer and Andrew Aromando as Chief Business Officer—as the company sharpens its focus on late-stage development and strategic transactions.

Both men previously played key roles in Ambrx Biopharma’s $2 billion acquisition by Johnson & Johnson and bring a track record of value creation in oncology-focused biotechs. Their arrival signals a deliberate pivot toward unlocking the value of pelareorep, Oncolytics’ virus-based immunotherapy currently in multiple mid-to-late-stage studies.

“Pelareorep’s clinical data across multiple tumors is striking and represents the potential for a true backbone immunotherapy to address many in-need indications,” said CEO Jared Kelly. “With a renewed focus and sharpened clinical development plan, we believe we will move pelareorep forward effectively and efficiently to a place where potential partners will see the value of a de-risked immunotherapy.”

As CBO, Aromando is now leading global business development and helping shape the company’s corporate, clinical, and regulatory strategies. The leadership tandem is expected to prioritize partnering and expansion opportunities while preserving capital efficiency—a strategy well-suited for pelareorep’s growing clinical profile.

“I’m thrilled to join Oncolytics at such a pivotal moment in its evolution,” said Aromando. “With promising data in difficult-to-treat cancers and a compelling body of clinical evidence in over 1,100 patients, I believe the Company is uniquely positioned to deliver meaningful value to patients and other stakeholders in the near term.”

Pelareorep holds FDA Fast Track designation in both metastatic pancreatic ductal adenocarcinoma (mPDAC) and HR+/HER2- metastatic breast cancer (mBC), and has shown encouraging synergy with checkpoint inhibitors and chemotherapy.

In mPDAC, Phase 2 data showed objective response rates above 60% in tumor-evaluable patients, exceeding historical benchmarks, with survival at two years also outperforming expectations. Meanwhile, in HR+/HER2- mBC, two randomized phase 2 trials (IND-213 and BRACELET-1) demonstrated overall survival trends that support continued development.

The drug’s potential may extend even further. A Phase 2 anal cancer cohort combining pelareorep with a checkpoint inhibitor produced responses that surpassed historical checkpoint monotherapy outcomes, suggesting broader utility. Most recently, new data from the GOBLET trial presented at ASCO 2025 highlighted pelareorep’s ability to activate both innate and adaptive immune responses in metastatic pancreatic cancer—reinforcing its potential as a backbone immunotherapy.

With experienced leadership now in place and a growing clinical footprint, Oncolytics is advancing toward potential partnership, planning registration-enabling trials, and commercialization readiness—all while maintaining a disciplined, investor-aligned approach to capital and growth.

CONTINUED… Read this and more news for Oncolytics Biotech at: https://usanewsgroup.com/2023/10/02/the-most-undervalued-oncolytics-company-on-the-nasdaq/

In other recent industry developments and happenings in the market include:

Instil Bio, Inc. (NASDAQ: TIL) has received U.S. FDA clearance for its IND application of AXN-2510, a PD-L1xVEGF bispecific antibody, setting the stage for a Phase 1 trial in relapsed or refractory solid tumors. The trial is expected to begin before the end of 2025 and will assess multiple endpoints, including safety, efficacy, and pharmacokinetics.

“We are pleased to announce the clearance of the ‘2510 IND by the FDA,” said Jamie Freedman, M.D., Ph.D., Chief Medical Officer of Instil. “Evaluating ‘2510 in a global population will be a critical milestone in the clinical development of ‘2510.”

Additional data from a separate Phase 2 study in first-line NSCLC in China is expected later this year.

Agenus Inc. (NASDAQ: AGEN) has partnered with AI firm Noetik to develop predictive biomarkers for its BOT/BAL immunotherapy regimen using large-scale virtual cell models.

"This collaboration with Noetik enables us to harness cutting-edge AI to better understand patient biology and tailor treatments more precisely," said Dr. Garo Armen, Chairman and CEO of Agenus. " By integrating Noetik’s virtual cell models with our expansive BOT/BAL clinical dataset, we have the potential to accelerate the identification of predictive biomarkers, enhance the success of our pivotal trials, and ultimately improve outcomes for patients who currently have limited or no treatment options."

The collaboration will apply Noetik’s foundation models to real clinical data, aiming to better identify which patients are most likely to benefit from treatment. This approach could accelerate trial outcomes and personalize treatment pathways in difficult-to-treat cancers.

Perspective Therapeutics, Inc. (NYSE-American: CATX) has opened recruitment for the third dosing cohort of its ongoing Phase 1/2a trial evaluating [212Pb]VMT-α-NET in patients with unresectable or metastatic somatostatin receptor 2 (SSTR2)-positive neuroendocrine tumors. The new cohort involves a fixed administered dose up to 20% higher than the previous level, following alignment with the FDA.

"We are encouraged by the overall clinical profile observed at the second dose level of VMT-α-NET—including evidence of anti-tumor activity and primarily low-grade adverse events—and we believe it is important to assess whether a higher dose could further improve the therapeutic profile," commented Markus Puhlmann, Chief Medical Officer of Perspective. "Meanwhile, we remain committed to engaging with the FDA to evaluate the clinical utility of dosimetry estimates and analyses in the development of our proprietary RPTs."

Clinical updates, including longer-term safety and anti-tumor data, are expected in the second half of 2025.

MacroGenics, Inc. (NASDAQ: MGNX) has signed a royalty purchase agreement with Sagard Healthcare Partners, securing a $70 million upfront payment tied to future global sales of ZYNYZ (retifanlimab-dlwr), a PD-1 inhibitor approved for advanced squamous cell carcinoma of the anal canal and metastatic Merkel cell carcinoma.

Both indications are cancer-related, with ZYNYZ marketed by Incyte in the U.S. and backed by accelerated FDA approvals. Under the agreement, Sagard will collect royalties until it doubles its investment, after which all future royalties revert back to MacroGenics. The deal extends MacroGenics’ cash runway into 2027 and supports continued development of its oncology pipeline.

Source: https://usanewsgroup.com/2024/09/21/is-oncolytics-biotech-the-markets-most-undervalued-cancer-opportunity/

CONTACT:

Baystreet.ca

[email protected]

(250) 999-4849

DISCLAIMER: Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. Baystreet.ca is a wholly-owned subsidiary of Baystreet.ca Media Corp. (“BAY”) BAY has been not been paid a fee for Oncolytics Biotech Inc. advertising and/or digital media, but the owner(s) of BAY also own Market IQ Media Group, Inc., which has been paid a fee from the company directly. There may be 3rd parties who may have shares Oncolytics Biotech Inc., and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of BAY own shares of Oncolytics Biotech Inc. which were purchased in the open market. BAY and all of it’s respective employees, owners and affiliates reserve the right to buy and sell, and will buy and sell shares of Oncolytics Biotech Inc. at any time thereafter without any further notice. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material disseminated by BAY has been approved by the above mentioned company; this is a paid advertisement, and we own shares of the mentioned company that we will sell, and we also reserve the right to buy shares of the company in the open market, or through other investment vehicles. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.