- Newgioco is a licensed gaming operator retail web-based and land-based gaming services in Italy

- The company is now eyeing the U.S. market

- Newgioco stands to benefit as more and more states in U.S. look to relax ban on sports betting

The 10-year price chart for the VanEck Vectors Gaming ETF (BJK) shows how the global gaming industry has been through ups and downs in the past decade.

Google Finance

BJK, which tracks the S-Network Global Gaming Index, saw a huge drop after the financial crisis. The drop was understandable as consumer confidence, a key driver for the gaming industry, was at its lowest point post the credit bubble burst. Interestingly, the index bounced back in 2009 itself and then saw a steady rise, peaking by the end of 2013. Now these gains were driven to a large extent by excess liquidity in the market thanks to Fed’s multiple QE programs. But they were also driven by a resurgent gaming industry that was helped by the boom in Macau. After Las Vegas suffered post the financial crisis, big casino operators such as Las Vegas Sands (LVS) and MGM Resorts (MGM) shifted focus to the Chinese territory.

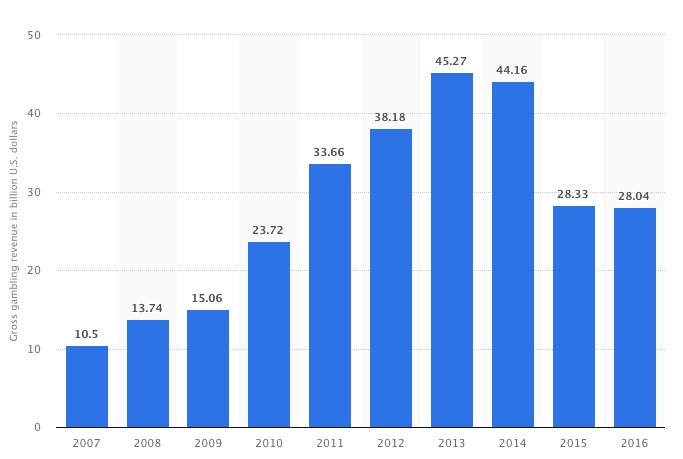

The gambling boom in Macau was driven by the booming Chinese economy. The chart below from Statista shows the gross revenue from gambling and gaming in Macau between 2007 and 2016. The chart mirrors the performance of BJK, with increasing revenue post 2009 and peak at 2013.

Statista

The slowdown in Macau was due to multiple factors. The Chinese economy began to slowdown in 2013 after the infrastructure investment and export-led boom slowed. Economists say that some of the growth slowdown was intentional as China wanted to shift to consumer-led growth. That should have helped the gaming industry in Macau, but at the same time Chinese authorities also cracked down on corruption and this had an effect on the industry in Macau. You see many of the “high rollers” in Macau were on the government’s crackdown list. That curbed big spending. After a sluggish 2015 and 2016, gaming revenue rebounded in Macau and this reflects in the performance of BJK last year.

Apart from the rebound in Macau gaming revenue, BJK also gained on hopes that states in the U.S. will continue to relax ban on sports betting. Newgioco Group (NWGI), a certified betting platform technology provider and regulated lottery and gaming retailer, could benefit significantly from the easing of ban on sports betting in the U.S.

About Newgioco

In today’s fast-paced market, there’s a relatively small window between a company “flying under-the-radar” and achieving increased investor awareness. This article aims to increase investor awareness about Newgioco at a time when the company is on the verge of achieving something significant.

Newgioco is incorporated in state of Delaware and was previously known as Empire Global Corp. NWGI operates as a licensed gaming operator retail web-based and land-based gaming services in Italy. The company operates through its wholly-owned subsidiaries Multigioco Srl (Multigoco) and Rifa Srl (Rifa). The company expanded its land-based footprint through the acquisition of Ulisse Gmbh. The company acquired its innovative state-of-the-art betting technology platform through the acquisition of Odissea Betriebsinformatik Beratung Gmbh.

Strong Fundamentals

The Italian regulated online leisure gaming market saw significant growth in 2016. The market was valued at $1.2 billion after payout in 2016, according to Polytechnical Institute of Milano. This represents substantial growth from 2015 when the market after payout was valued at $860 million. Moreover, the market likely reached $1.8 billion in 2017. The regulated online leisure gaming market in Italy is the second largest in the EU after UK. More important, there is a great deal of consolidation in recent years unlike the UK where the market is extremely competitive.

The data from Polytechnical Institute of Milano also shows that the median spending of leisure betting players in Italy stands at $57 per month.

The robust Italian market has allowed NWGI to register strong growth in its business. The company’s betting turnover reached $77 million by the end of 2015. In 2016, NWGI registered 43% growth in betting turnover, crossing the $100 million mark and ending the year at $122 million. Betting turnover likely exceeded $200 million in 2017, according to NWGI’s estimates. In 2018, the company expects turnover to reach $234 million.

Strong betting turnover has translated into robust revenue growth for NWGI over the last three years. Revenue in 2016 stood at under $9 million but is expected to more than double in 2018. NWGI also expects to turn EBITDA positive in 2017 when it reports full year results. EBITDA is expected to reach $5 million this year.

Growth Drivers

In its main market, Italy, NWGI expects to see growth from increasing use of mobile. As more and more people switch to smartphones and tablets, NWGI expects continuous growth in its core market. The second growth driver for NWGI is going to be its increasing marketing and branding efforts. While the Italian market is the second biggest online leisure gaming market in EU, only 5% of active players currently play online. Switching these users through marketing and branding efforts will be a key growth driver. The company has marked 2018 as the year to increase awareness among gamers. Growth will be also driven by ongoing acquisitions.

NWGI also stands to benefit from the boom in cryptocurrencies we have seen in the last one year. The company’s betting platform is cryptocurrency/blockchain ready.

By far the biggest growth driver for NWGI and something that could provide a big boost to its shares will be the initiation of process for obtaining operating licensing in the U.S. As noted earlier, the sports betting market in the U.S. is still at the nascent stage. But several states keen on legalizing it, NWGI is planning to enter the market at the perfect time.

Risks

The major risk to the NWGI story is of course if the U.S. market doesn’t take off due to existing regulations. But with a market cap of just under $26 million, the possibility of U.S. expansion is not even priced into the stock. In fact, the current valuation does not even reflect the robust operations NWGI has built in Italy. The other risk with NWGI is illiquidity. The stock trades on a daily average volume of just 37,870. That makes it unattractive to institutional investors. However, NWGI does have plans to complete an IPO and exchange listing in 2018. This would go a long way in improving visibility.

Disclaimer:

Except for the historical information presented herein, matters discussed in this release contain forward-looking statements that are subject to certain risks and uncertainties that could cause actual results to differ materially from any future results, performance, or achievements expressed or implied by such statements. WFM, Inc. is not registered with any financial or securities regulatory authority, and does not provide nor claims to provide investment advice or recommendations to readers of this release. For making specific investment decisions, readers should seek their own advice. For full disclosure, please visit: http://wwfinancial.com/legal-disclaimer/.