Distributed on behalf of Trident Resources Corp.

Gold prices are pushing higher again. Last trading at $3,392, it could test $3,500 shortly after, especially if the Federal Reserve aggressively cuts interest rates in September. All of which would be a solid catalyst for gold stocks, such as Trident Resources Corp. (TSXV: ROCK) (OTCQB: TRDTF), Newmont Corporation (NYSE: NEM) (TSX: NGT), Barrick Mining (NYSE: B) (TSX: ABX), Royal Gold (NASDAQ: RGLD), and Kinross Gold (NYSE: KGC) (TSX: K).

Helping, the Federal Reserve’s Michelle Bowman argues that interest rates should be lower after a weaker-than-expected jobs report. That was after U.S. employers added just 73,000 jobs in July, which was short of expectations of 115,000.

Plus, revisions for May and June payrolls shaved off 258,000 jobs.

“A notable deterioration in U.S. labor market conditions appears to be underway,’' said Scott Anderson, chief U.S. economist at BMO Capital Markets, as quoted by the Associated Press. “We have been forecasting this since the tariff and trade war erupted this spring and more restrictive immigration restrictions were put in place. Overall, this report highlights the risk of a harder landing for the labor market.’'

That was a key part of Bowman’s argument for at least three rate cuts this year, with the central bank set to meet another three times in 2025.

That said, should we see aggressive cuts this year, gold stocks could soar, including:

Trident Resources Corp. (TSXV: ROCK) (OTCQB: TRDTF)

Trident Resources Corp. just announced the commencement of its inaugural 5,000 metre diamond drilling program at the Company’s flagship Contact Lake Gold Project, located in the prolific La Ronge Gold Belt of northern Saskatchewan.

Contact Lake Project Location Map:

https://www.tridentresourcescorp.com/projects/contact-lake-gold-project/#&gid=1&pid=1

This marks the first drill campaign at Contact Lake in nearly 30 years and represents an important milestone for Trident as it begins to unlock the potential of one of the region’s most prospective underexplored gold projects. The program has been designed to confirm historical mineralization, expand known gold zones, and test newly defined targets generated through modern geological interpretation and fieldwork.

Drill Program Overview:

The Phase 1 drill program will consist of 5,000 metres, targeting high-priority zones and confirmation of historical data.

Location Map of Planned Drill Holes: http://www.tridentresourcescorp.com/_resources/images/Drill-Plan-NR-202508.jpg

Expansion Potential:

Contact Lake has a long history of gold exploration yet remains largely underexplored by contemporary methods. The La Ronge Gold Belt hosts several past-producing mines and advanced gold deposits, and management believes Contact Lake has strong potential to evolve into a cornerstone.

Jonathan Wiesblatt, CEO of Trident Resources, commented: “Launching our first drill program at Contact Lake is an exciting step forward for Trident and our shareholders. This 5,000 metre program is designed not only to validate historical results but also to demonstrate the expansion potential at the project. With gold mineralization identified historically and modern exploration techniques now being applied for the first time, we believe Contact Lake has the potential to become one of the more significant new gold projects in the La Ronge Gold Belt.”

Next Steps:

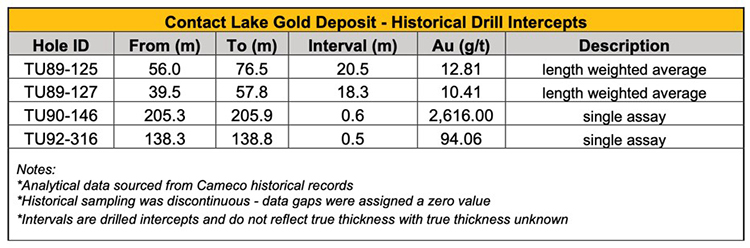

Drilling is expected to continue through fall 2025, with first assay results anticipated later this year. The Company will provide updates as results become available. Drilling will target past-producing Contact Lake Mine, following up on historical high-grade intercepts including:

Other related developments from around the markets include:

Newmont just announced that the Parliament of Ghana has ratified the renewal of the Akyem East Mining Lease. Per Newmont’s definitive agreement to divest its Akyem operation in the Republic of Ghana, Zijin Mining Group Co., Ltd. agreed to pay Newmont $100 million upon receipt of the Lease Ratification. The payment has been received, bringing total after-tax cash proceeds from the sale of Akyem to approximately $770 million. With today’s announcement, Newmont now expects to generate $3.1 billion in after-tax cash proceeds from its divestiture program in 2025, including $2.6 billion from divested assets and approximately $470 million from the sale of equity shares in Greatland Resources Limited and Discovery Silver Corp. The proceeds will support Newmont’s capital allocation priorities, which include reducing outstanding debt and returning capital to shareholders.

Barrick Mining Corporation delivered a strong performance in the second quarter, increasing gold and copper production, growing free cash flow1 and advancing its pipeline of Tier One2 projects — all while returning more capital to shareholders. The performance builds on the first quarter’s positive start to the year and positions the Company for an even stronger second half. Net earnings per share rose to $0.47 for the quarter, with adjusted net earnings per share1also at $0.47. Operating cash flow for the first half of the year was $2.5 billion, 32% higher than the prior-year period, while free cash flow1 totaled $770 million, up 107% on the prior-year period, supported by stronger commodity prices. “Q2 was another quarter where Barrick delivered on all fronts. We’re growing production, lowering costs and advancing the industry’s most exciting pipeline of gold and copper projects. From the ramp-up at Goldrush to the progress at Pueblo Viejo, Lumwana and Reko Diq, not to mention the transformational potential of Fourmile, we’re demonstrating the strength and depth of our portfolio,” said president and chief executive Mark Bristow.

Royal Gold announced that its Board of Directors has declared its fourth quarter dividend of $0.45 per share of common stock. The dividend is payable on Friday, October 17, 2025, to shareholders of record at the close of business on Friday, October 3, 2025. In addition, the company reported net income of $132.3 million, or $2.01 per share, for the quarter ended June 30, 2025, on revenue of $209.6 million and operating cash flow of $152.8 million. Adjusted net income1 was $118.8 million, or $1.81 per share. “Royal Gold produced another quarter of excellent financial results, with record revenue, earnings and operating cash flow, demonstrating again the leverage in our business to strong precious metal prices,” commented Bill Heissenbuttel, President and CEO of Royal Gold. “We always seek to improve our business and we saw opportunities recently to take significant steps to position Royal Gold as a premier growth company in the streaming and royalty sector," continued Mr. Heissenbuttel. "The acquisitions of Sandstorm Gold and Horizon Copper will bring scale, growth and diversification to Royal Gold and make us the most diversified and gold-focused company in our sector."

Kinross Gold announced that the Company’s Board of Directors has declared a dividend of US$0.03 per common share for the second quarter of 2025. The dividend is payable on September 4, 2025, to shareholders of record as of the close of business on August 21, 2025. This dividend qualifies as an “eligible dividend” for Canadian income tax purposes while dividends paid to shareholders outside Canada (non-resident investors) will be subject to Canadian non-resident withholding taxes. In addition, J. Paul Rollinson, CEO, noted, “Our portfolio of mines continued to perform well during the quarter contributing to a strong first half of the year and positioning us well to achieve our full-year guidance. The Company delivered a 21% increase in margins of $2,204 compared with Q1 2025, outpacing the 15% increase in the gold price over the same period. We also delivered record free cash flow of approximately $650 million, which increased by 74% compared with the previous quarter. Since reactivating our share buyback program earlier this year, we have repurchased $225 million in shares of the $500 million planned for the year, while maintaining our quarterly dividend and significantly strengthening our investment-grade balance sheet.”

Legal Disclaimer / Except for the historical information presented herein, matters discussed in this article contains forward-looking statements that are subject to certain risks and uncertainties that could cause actual results to differ materially from any future results, performance or achievements expressed or implied by such statements. Winning Media is not registered with any financial or securities regulatory authority and does not provide nor claims to provide investment advice or recommendations to readers of this release. For making specific investment decisions, readers should seek their own advice. Winning Media is only compensated for its services in the form of cash-based compensation. Pursuant to an agreement Winning Media has been paid three thousand five hundred dollars for advertising and marketing services for Trident Resources Corp. by Trident Resources Corp. We own ZERO shares of Trident Resources Corp. Please click here for disclaimer.

Contact:

Ty Hoffer

Winning Media

281.804.7972

[email protected]