Issued on behalf of RUA GOLD Inc.

VANCOUVER – Baystreet.ca News Commentary – Even with ongoing market volatility and surging gold prices, JP Morgan continues to stand by its forecast of gold hitting $4,000 per ounce by the second quarter of 2026. Bullish sentiment in the sector is gaining momentum, with Morningstar Equity Research emphasizing that elevated gold prices are creating favorable conditions for mining equities. Jefferies has also joined the chorus, raising its price targets for a number of gold producers ahead of their next round of earnings. Among the names drawing increased investor focus are RUA GOLD Inc. (TSXV: RUA) (OTCQB: NZAUF), Allied Gold Corporation (TSX: AAUC) (OTCQX: AAUCF), SSR Mining Inc. (NASDAQ: SSRM) (TSX: SSRM), Sandstorm Gold Ltd. (NYSE: SAND), and Lumina Gold Corp. (TSXV: LUM) (OTCQB: LMGDF).

Gold’s reputation as a safe-haven asset is once again being validated, with both demand and prices climbing steadily in 2025. Investors looking for exposure to the sector have seen strong performance from junior gold miners, particularly through ETFs. The VanEck Junior Gold Miners ETF (GDXJ) has surged 44.80% year-to-date, while the Sprott Junior Gold Miners ETF (SGDJ) isn’t far behind, up 39.58% as of April 24.

New Zealand-focused gold exploration company, RUA GOLD Inc. (TSXV: RUA) (OTCQB: NZAUF), recently reported encouraging new drill results from its Auld Creek project in the historic Reefton Goldfield, with assays pointing to improved gold grades at depth along the Fraternal ore shoot. Standout intercepts include 9.0 meters at 5.9 g/t gold equivalent (5.2 g/t Au and 0.16% Sb) from hole ACDDH027, and 1.25 meters at 48.3 g/t AuEq (13.3 g/t Au and 8.1% Sb) from ACDDH028. Importantly, these results—returned from 80 to 100 meters beneath the current resource envelope—appear to confirm that gold-antimony mineralization intensifies with depth, supporting the company’s model of a high-grade, south-plunging zone that remains open.

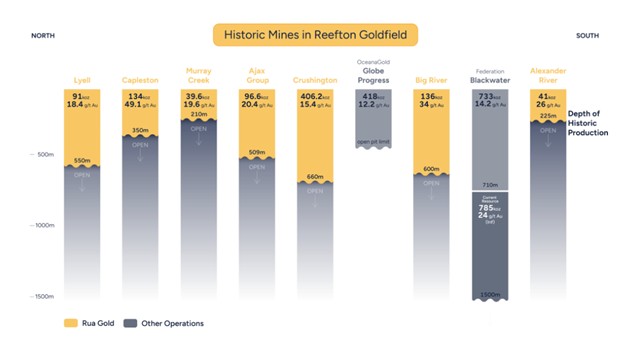

The Auld Creek project represents just one component of RUA’s broader 2025 exploration push across the Reefton district, where the company now holds 95% control over the historic goldfield.

RUA Gold is taking a fresh approach to one of New Zealand’s most storied gold districts—becoming the first modern explorer to deploy advanced geological modeling and AI-driven targeting across the Reefton Goldfield.

And it's working.

At Auld Creek, the company’s flagship project, early drill campaigns have already delivered hits like 12 meters at 12.2 g/t gold equivalent, including a standout 2 meters at 54.8 g/t gold, while surface sampling has uncovered antimony grades topping 40%. Four mineralized shoots have been confirmed so far, but only two are factored into the current inferred resource: 700,000 tonnes grading 3.1 g/t gold and 1.1% antimony—suggesting considerable room to grow.

Meanwhile, the 2025 drill season is expanding across the district.

Active programs are now underway at Murray Creek and the Gallant prospect within the Cumberland camp. As a target prioritized by modern AI technology, Gallant sits just 3 kilometers from the historic Globe Progress mine, where OceanaGold pulled more than 610,000 ounces of gold between 2007 and 2016, on top of the 424,000 ounces produced before 1950. Taken together, the Reefton belt has historically yielded over 2 million ounces, with grades that once reached 50 g/t.

Gallant is being tested for potential extensions of a previously reported 20.7-meter vein grading 62.2 g/t gold, including a 1-meter blast of 1,911 g/t. At Murray Creek, visible gold has now been noted in the majority of holes—an encouraging sign for a system still in its early innings.

But RUA’s ambitions don’t end in Reefton.

On the North Island, the company is advancing its Glamorgan Project, located near OceanaGold’s Wharekirauponga (WKP) deposit. There, two large gold-arsenic anomalies—spanning more than 4 kilometers—have been mapped, and rock samples have returned assays as high as 43 g/t gold. With drill targeting already underway, Glamorgan could emerge as the company’s next high-impact play.

Although gold remains the central theme, antimony is quietly shaping up as a strategic wild card. In January 2025, New Zealand added antimony to its official Critical Minerals List. With global supplies tightening and prices rising above US$50,000 per tonne, intercepts like 0.3 meters at 27.2 g/t gold and 1.35% Sb are starting to draw meaningful investor attention.

With a team behind $11 billion in mining exits, and $5.75 million in fresh capital, RUA Gold is not just exploring—it’s executing on a clear plan to unlock overlooked, high-grade potential across one of the Southern Hemisphere’s most underexplored gold belts.

CONTINUED… Read this and more news for RUA GOLD at: https://usanewsgroup.com/2025/04/02/others-found-1911-g-t-here-before-now-a-proven-11b-mining-team-is-back-to-finish-the-job/

In other industry developments and happenings in the market include:

Currently in the process of seeking an upgrade to a NYSE listing, Allied Gold Corporation (TSX: AAUC) (OTCQX: AAUCF) recently achieved its highest-ever quarterly gold output in Q4 2024, producing 99,632 ounces across its operations. Sadiola led the way with 54,210 ounces, fueled by oxide ore from Korali-Sud, while Agbaou and Bonikro in Côte d'Ivoire delivered 25,163 and 20,259 ounces respectively.

The company is advancing major expansion projects, including a plant upgrade at Sadiola and continued development of the Kurmuk project, which is expected to begin production by mid-2026. These initiatives support Allied’s strategic goal of scaling to 400,000+ ounces annually while reducing all-in sustaining costs over time.

SSR Mining Inc. (NASDAQ: SSRM) (TSX: SSRM) expects to produce between 410,000 and 480,000 gold equivalent ounces (GEOs) in 2025, excluding any contribution from Çöpler, which remains on care and maintenance. This guidance reflects a +10% year-over-year increase and includes production from its newly acquired CC&V mine, alongside Marigold, Seabee, and Puna.

"Our Americas assets, recently bolstered by the acquisition of CC&V, are well positioned for significant production growth and strong cash flows in 2025,” said Rod Antal, Executive Chairman of SSR Mining. “In addition, we see attractive and low capital intensity opportunities to potentially extend the mine lives at each of these assets going forward and will continue to progress technical work through the year.

Growth capital of up to $140 million will be directed largely toward advancing the Hod Maden project in Türkiye, with a construction decision expected to follow continued development.

In Q1 2025, Sandstorm Gold Ltd. (NYSE: SAND) generated an estimated 18,500 attributable gold equivalent ounces, derived from royalty and stream revenues totaling $53.3 million, excluding non-controlling interest. This translates into a cash operating margin of $2,507 per ounce, based on a realized gold price of $2,880 and average cash costs of just $373 per ounce.

The company continues to emphasize its capital-light model, offering upfront financing in exchange for long-term production rights. With 40 producing royalties out of a total 230 in its portfolio, Sandstorm is positioning itself for further growth through selective acquisitions.

Lumina Gold Corp. (TSXV: LUM) (OTCQB: LMGDF) recently agreed to be acquired by CMOC for C$1.27 per share, valuing the company at C$581 million in an all-cash deal. The offer represents a 71% premium to Lumina’s 20-day VWAP, and 52.3% of shareholders have already pledged support.

The deal followed upon the announcement of key power approvals at the company’s Cangrejos gold-copper project. The CMOC transaction will also include US$20 million in interim financing for Lumina and is expected to close in Q3 2025, pending approvals.

Article Source: https://usanewsgroup.com/2025/04/02/others-found-1911-g-t-here-before-now-a-proven-11b-mining-team-is-back-to-finish-the-job/

CONTACT:

Baystreet.ca

[email protected]

(250) 661-3391

DISCLAIMER: Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. Baystreet.ca is owned by Baystreet.ca Media Corp. (“BAY”). BAY has been paid a fee for RUA GOLD Inc. advertising and digital media from the company directly (forty-five thousand dollars Canadian for a three month contract subject to the terms and conditions of the agreement from the company direct). There may be 3rd parties who may have shares of RUA GOLD Inc., and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of “BAY” DOES NOT own any shares of RUA GOLD Inc. at this time, but reserves the right to buy and sell, and will buy and sell shares of RUA GOLD Inc. at any time without any further notice commencing immediately and ongoing. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material, including this article, which is disseminated by BAY has been approved by RUA GOLD Inc. Technical information relating to RUA GOLD Inc. has been reviewed and approved by Simon Henderson, CP, AUSIMM, a Qualified Person as defined by National Instrument 43-101. Mr. Henderson is Chief Operational Officer of RUA GOLD Inc., and therefore is not independent of the Company; this is a paid advertisement, we currently own shares of RUA GOLD Inc. and will buy and sell shares of the company in the open market, or through private placements, and/or other investment vehicles. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.