Issued on behalf of RUA GOLD Inc.

VANCOUVER – Baystreet.ca News Commentary – Trump’s tariff threats continue to cause turbulence in the market, with gold prices and gold stocks benefitting the most, as several gold miners continue to flash buy signals. Prior to the end of last week, gold extended its rise to climb above the $3,350 mark, as investors have moved back into safe-haven mode. All this action prompted Citi to revise its short-term gold price target to $3,500, and Bank of America to grow its holdings in a major miner in the 4th quarter. As gold prices remain favourable, the market’s been witnessing important catalysts from junior gold miners, including developments from RUA GOLD Inc. (TSXV: RUA) (OTCQB: NZAUF), New Found Gold Corp. (NYSE-American: NFGC) (TSXV: NFG), West Red Lake Gold Mines Ltd. (TSXV: WRLG) (OTCQB: WRLGF), Perpetua Resources Corp. (NASDAQ: PPTA) (TSX: PPTA), and STILLR Gold Inc. (TSX: STLR) (OTCQX: STLRF).

The article continued: Analysts at Jefferies and InsideExploration both agree juniors are still trading at 2018–2019 levels, even though gold is up nearly 40% since then. Veteran investor Rob McEwen and billionaire fund manager John Paulson both see gold approaching $5,000 in the coming years, while JPMorgan recently raised eyebrows with a bold projection: if just 0.5% of U.S.-held foreign assets were reallocated to gold, the metal could surge to $6,000 per ounce by 2029, both being moves that could trigger a broad revaluation across the mining sector.

RUA GOLD reports high-grade gold intercepts from drilling at Cumberland, including 1m @ 26.9g/t Au and 1m @ 16.2 g/t Au, confirming continuity of mineralization at the Gallant target

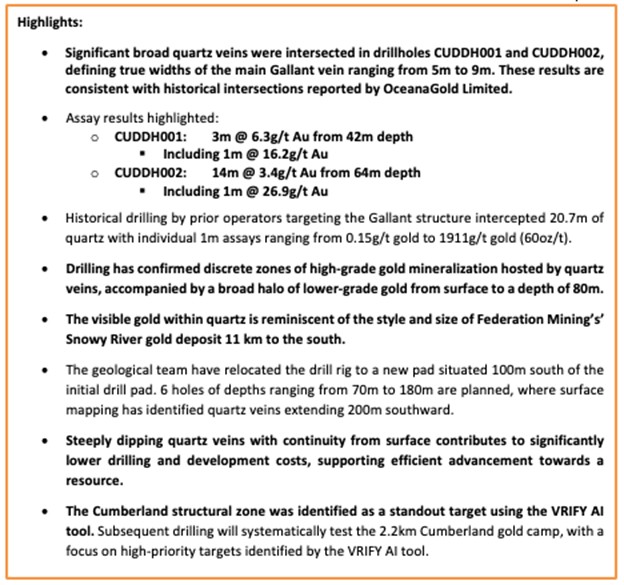

RUA GOLD Inc. (TSXV: RUA) (OTCQB: NZAUF) has announced high-grade gold intercepts [JC1] from the first two holes drilled at its Cumberland gold project in New Zealand’s historic Reefton Goldfield. The initial drill results include 1 meter at 26.9 g/t gold and another at 16.2 g/t, confirming both the continuity and near-surface nature of the Gallant vein system—an area previously identified by the company’s AI-driven targeting model.

The campaign marks the first test of the Gallant target using VRIFY’s AI-assisted exploration platform, which ranked the zone as a high-priority structure within the broader 2.2-kilometer-long Cumberland gold camp. Drilling has now verified that the steeply dipping quartz veins host wide mineralized zones up to 14 meters thick, with multiple high-grade shoots. These early results are being used to inform a follow-up program stepping 100 meters south along strike, where quartz veins remain visible at surface.

“From the very first drill holes, we intersected significant, wide quartz veins hosting high-grade gold, confirming historical intercepts,” said Robert Eckford, CEO of RUA GOLD. “This validates the VRIFY AI targeting process and confirms near-surface mineralization with the potential to extend across a 2-kilometer zone. It’s a major step forward for our hub-and-spoke strategy in Reefton… The Gallant prospect represents the first VRIFY AI target that we have drilled so far. This structure is traceable on surface for over 600m and remains largely untested along strike and at depth.”

The Gallant structure, located just 3 kilometers from the past-producing Globe-Progress Mine, was previously drilled by OceanaGold, which returned standout results including 20.7 meters of quartz with intervals grading as high as 1,911 g/t gold (60 oz/t). The current campaign confirms mineralization from surface to depths of 80 meters and remain open, suggesting potential for a shallow, low-cost resource. The simplicity of access—via road and existing infrastructure—adds further upside as the company accelerates toward a defined resource.

Beyond the headline grades, the VRIFY platform played a central role in fast-tracking this discovery. RUA’s team fed over 170,000 historical and recent data points into the system, allowing for rapid high-confidence targeting across the district. According to the company, what would have taken months to interpret manually was narrowed down to viable drill zones in minutes.

Now underway, the follow-up program at Gallant will include additional holes 100 meters south along strike. Assays are pending for drillhole CUDDH007, while drillholes 003 and 004 suggest a structural offset to the north and a steeper dipping of the vein. Historic mining records from the Cumberland camp report an average recovered grade of 26.1 g/t gold across seven different lodes, underscoring the long-term potential of the district.

If future holes continue to deliver on the AI’s promise, the Gallant zone could form the backbone of a scalable gold operation across the Reefton belt—leveraging modern discovery tools to unlock one of New Zealand’s most storied mining regions.

With a modest market cap and multiple exploration targets across the Reefton belt, RUA GOLD offers high leverage to drill success. The steep, near-surface nature of the Gallant veins supports lower drilling and development costs, adding further upside to any future resource. If results continue to hold along strike, the Gallant vein could become the cornerstone of a broader multi-deposit strategy across one of New Zealand’s most historically productive gold districts.

CONTINUED… Read this and more news for RUA GOLD at: https://usanewsgroup.com/2025/04/02/others-found-1911-g-t-here-before-now-a-proven-11b-mining-team-is-back-to-finish-the-job/

In other industry developments and happenings in the market include:

New Found Gold Corp. (NYSE-American: NFGC) (TSXV: NFG) has hit more high-grade gold at the Dropkick zone on its Queensway Project in Newfoundland, including standout intervals like 42.8 g/t Au over 14.95 meters and 47.6 g/t Au over 3.95 meters. These results expand the mineralized strike at Dropkick to 580 meters, with mineralization now confirmed both west and east of the Appleton Fault Zone. Additional discoveries at the Pistachio zone also support the potential for future near-surface resource growth across this large, underexplored gold system.

“In these final drill results from the 2024 exploration program we continue to intersect high-grade gold mineralization and expand both Dropkick and Pistachio,” said Melissa Render, President of New Found Gold. “The continued results from Dropkick and Pistachio, located 8 and 11 kilometres north, respectively, of the main resource area at Queensway are highly encouraging and point to the potential for future near-surface resource expansion along the strike of this prolific gold mineralized system.”

West Red Lake Gold Mines Ltd. (TSXV: WRLG) (OTCQB: WRLGF) has approved the full restart of its Madsen Mine, marking a major milestone for the company’s turnaround strategy in Ontario’s prolific Red Lake District. The decision follows two years of technical de-risking, infrastructure upgrades, and a bulk sample that delivered gold grades aligned with internal models.

“This restart decision is a major milestone that has been achieved by systematically derisking the technical, operating, and funding requirements of a sustainable high-grade gold operation at Madsen,” said Shane Williams, President and CEO of West Red Lake Gold. “I am very pleased to deliver this restart to all key stakeholders, including our shareholders and neighbours.”

Processing is expected to begin at 500 tonnes per day, with throughput ramping up in the second half of 2025. With a 47 km² land package surrounding the mine and three past-producing assets nearby, WRLG is positioning itself as a rising mid-tier Canadian gold producer.

Perpetua Resources Corp. (NASDAQ: PPTA) (TSX: PPTA) has submitted a formal application to the U.S. Export-Import Bank (EXIM) for up to $2 billion in debt financing to develop its Stibnite Gold Project in Idaho.

“The Stibnite Gold Project is poised to be a national strategic asset for domestic antimony production and is also a world class gold asset,” said Jon Cherry, President and CEO of Perpetua Resources. “EXIM financing could play a pivotal role in advancing the Project to production so we can reestablish a secure supply of antimony for the United States for decades to come.”

The proposed funding, if approved, would cover a majority of project development costs and reestablish the only domestically mined source of antimony—critical to U.S. defense applications. This move follows receipt of the final federal permit and reflects a broader push to secure strategic mineral supply chains.

STILLR Gold Inc. (TSX: STLR) (OTCQX: STLRF) has published an updated PEA and Mineral Resource Estimate for the Tower Gold Project, showing a base case after-tax NPV of US$1.0 billion and projected gold output of 5.2 million ounces over a 19-year mine life. Average annual production is estimated at 273,000 ounces, with peak output of 325,000 ounces and a 92.7% recovery rate.

“Tower is one of Canada's largest undeveloped gold projects, with size and scale matched only by a few Canadian gold projects,” said Keyvan Salehi, President and CEO of STLLR Gold. “We believe the 2025 PEA delivers compelling economics with defensible capital and operating cost estimates.”

The updated geological model and mine plan—built from first principles—reflect over 516,000 meters of drilling and a rigorous approach to resource definition. A pre-feasibility study is underway and permitting is advancing, with Tower targeting shovel-ready status by 2029.

Article Source: https://usanewsgroup.com/2025/04/02/others-found-1911-g-t-here-before-now-a-proven-11b-mining-team-is-back-to-finish-the-job/

CONTACT:

Baystreet.ca

[email protected]

(250) 999-4849

DISCLAIMER: Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. Baystreet.ca is owned by Baystreet.ca Media Corp. (“BAY”). BAY has been paid a fee for RUA GOLD Inc. advertising and digital media from the company directly (forty-five thousand dollars Canadian for a three month contract subject to the terms and conditions of the agreement from the company direct). There may be 3rd parties who may have shares of RUA GOLD Inc., and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of “BAY” DOES NOT own any shares of RUA GOLD Inc. at this time, but reserves the right to buy and sell, and will buy and sell shares of RUA GOLD Inc. at any time without any further notice commencing immediately and ongoing. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material, including this article, which is disseminated by BAY has been approved by RUA GOLD Inc. Technical information relating to RUA GOLD Inc. has been reviewed and approved by Simon Henderson, CP, AUSIMM, a Qualified Person as defined by National Instrument 43-101. Mr. Henderson is Chief Operational Officer of RUA GOLD Inc., and therefore is not independent of the Company; this is a paid advertisement, we currently own shares of RUA GOLD Inc. and will buy and sell shares of the company in the open market, or through private placements, and/or other investment vehicles. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.